EVERGREEN’S INVESTMENT PHILOSOPHY

Evergreen’s investment philosophy has been derived from several books including Nick Murray’s “Simple Wealth, Inevitable Wealth” and Jeremy Siegel’s “Stocks for the Long Run”, as well as our own experience and research. These include:

Our philosophy is that stocks are less risky than bonds and have the best potential to outpace inflation over long periods of time. Historically, when looking through the lens of 10-year increments, investing in quality stocks has done more to grow and outpace inflation than other investments.

With history as our guide, there will be times when financial markets drop significantly in value…especially when looking at 5-year time increments or less. We help clients plan for this. We believe that a temporary decline is not the same as a loss when a solid plan is in place.

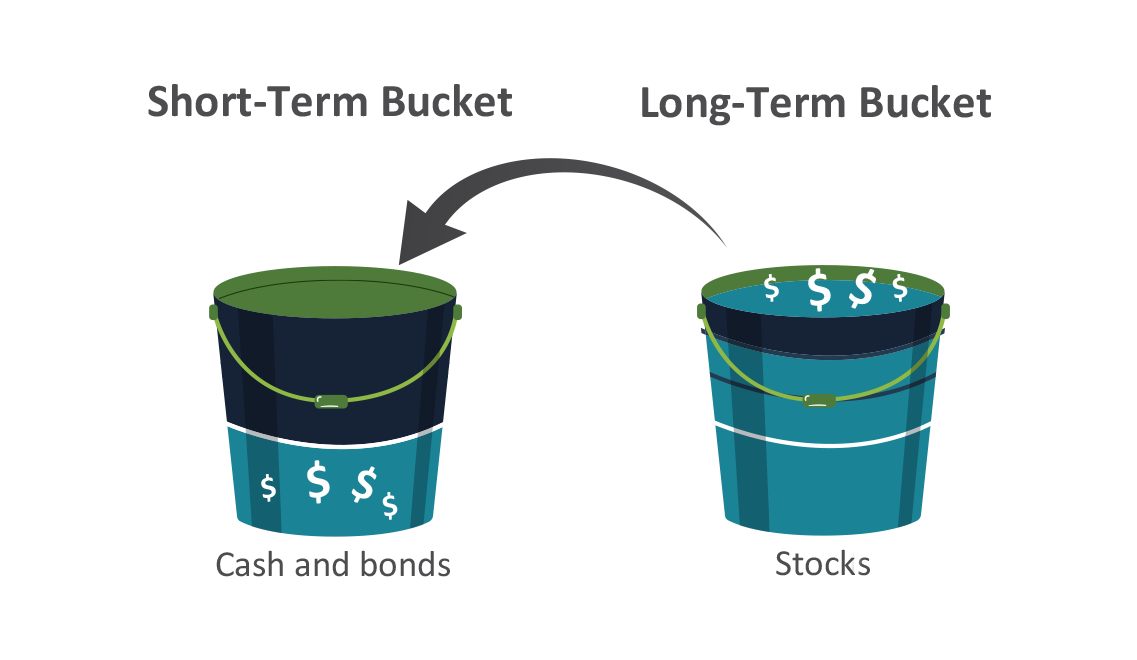

Each client is unique and has a portfolio allocation matched to their risk tolerance, goals, cash flow needs, and timeline. There is no “one size fits all” – each client has a comprehensive plan that is used as the basis for their investment allocations. Our first step in determining a client’s investment mix is based on the client’s cash flow needs and risk tolerance over the next 5 to 10 years, which we assign to their Short-Term Bucket and invest in bonds and cash that historically do not fluctuate as much up or down in value. The client’s remaining investable assets are then assigned to their Long-Term Bucket and invested in high-quality stocks that we believe have the greatest potential to outpace inflation over decades. We believe this approach helps clients have confidence and sleep well at night by knowing that they have enough set aside in more stable investments in their Short-Term Bucket to carry them through the next 5 years or more regardless of what might be happening in the stock market.

When cash is needed and the stock market is down, we pull from the Short-Term Bucket and allow the Long-Term Bucket time to recover and grow. Later, when the stock market is up, we sell from the Long-Term Bucket to replenish the Short-Term Bucket.

Clients do not choose the investments in the account directly. We are always happy to listen to our clients and your input is always welcome, but ultimately, we work best with clients who wish to delegate the day-to-day investment decisions to us to fully act as the Chief Financial Officer (CFO) of your family by enabling us and trusting our process to do what we believe is best when it comes to investing your accounts. We structure investment decisions according to the strategy that we develop with your input on your investment preferences, risk tolerance, and time horizon.

Lastly, we believe in long-term investing. We do not try to time the market because historically nobody can consistently do so. There will be times when financial markets drop significantly in value, but we help clients plan for this. We believe that temporary decline is not the same as a loss when a solid plan is in place. For the same reasons, we also do not day trade or chase after the hype of hot stock tips. As market conditions change, we are always scanning the horizon to make adjustments to the “sails of the investment ship” when we see appropriate opportunities but we never “jump out of the ship”. Sometimes the best thing is to do nothing at all. Ultimately, we help our clients develop and stick to a plan that is consistent and methodical and has the greatest chance for achieving success when measured by accomplishment of realistic financial goals.