EVERGREEN’S PROCESS FOR THE SEASONS

We have developed and refined a process to put all the pieces of the financial puzzle together through themed quarterly reviews primarily focused on tax planning, retirement planning, risk management, and investments.

- Investments – we work with you to understand the appropriate level of risk and reward. We also minimize or avoid unnecessary fees, and we continually refine your overall investment allocation as changes happen.

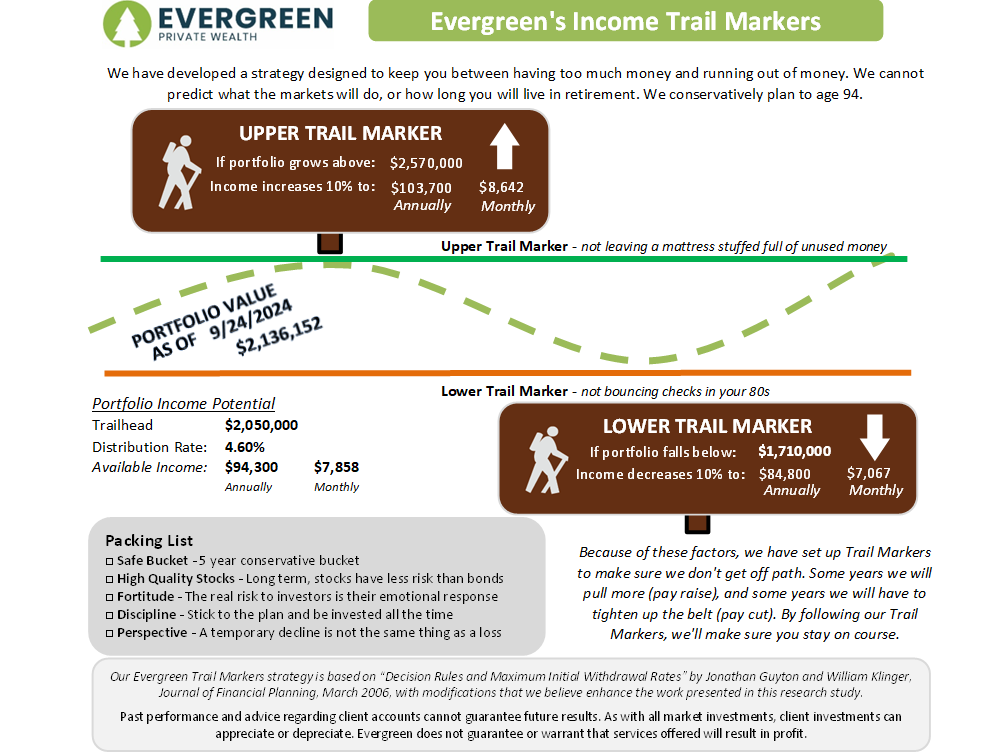

- Retirement Planning – we have found our client’s primary concern is understanding how much they can withdraw from their retirement savings without running out of money. At Evergreen we have developed a process called Income Trail Markers to provide our clients with a clear understanding of how much they can pull from their accounts. Learn more about Evergreens Income Trail Markers.

- Estate Planning – In partnership with Wealth.com, we review, update, or create your estate plan—saving time, cost, and stress (we are not attorneys)

- Risk Management – we work with you to evaluate appropriate life, umbrella, and long-term care insurance as well as put estate plans in place according to your wishes.

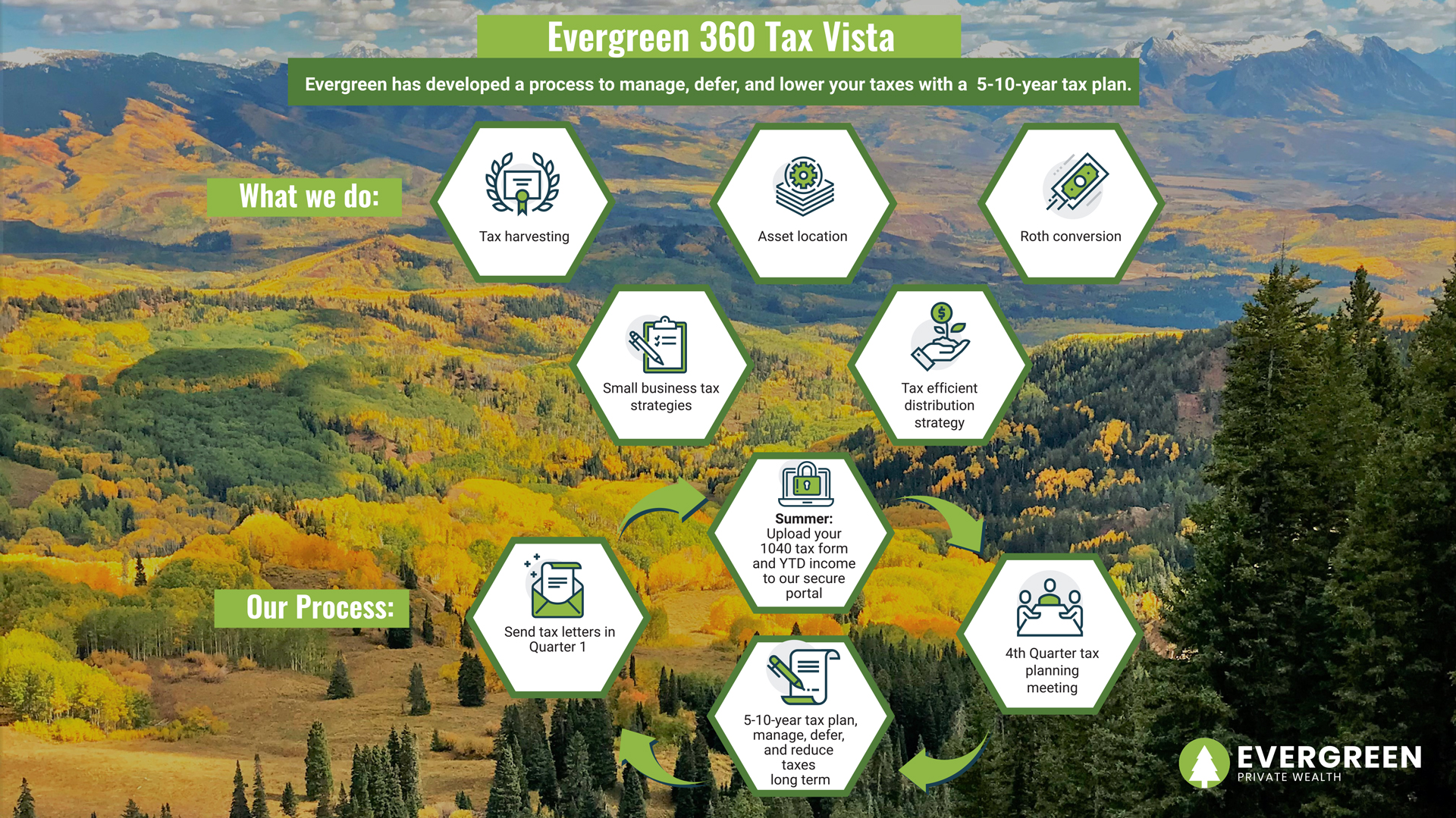

- Tax Planning – we work with our clients to create a 5-10-year tax plan, we review this tax plan each year in the fourth quarter to look for ways to manage, defer, and lower your taxes. Click here to see the Evergreen 360 Tax Vista.

Contact Personalized to You – although we prefer to meet quarterly, we adjust the level and frequency of our contact with you based on your preferences and needs.

We will always proactively reach out when things come up that you need to be aware of. This may be in regard to necessary plan updates, changes to your investment portfolio, statements and reviews, market updates, changes in laws affecting taxes or investments, and more.

RETIREMENT PLANNING:

Many individuals we’ve assisted tend to lose interest when we delve into discussions about Monte Carlo simulations and the likelihood of running out of money at age 94. They do not find it helpful. We have found what clients are looking for, which is, how much can I pull each year without running out of money. We have developed a strategy designed to ensure they don’t have a pile of money under the mattresses and also that they are not bouncing checks when they are in their 80s. If clients are willing to stay within the lower (tighten up the belt) and upper trail markers (pay increase) then we can have confidence that they will not run out of money in retirement and they will get the most out of their retirement.

Our Evergreen Trail Markers strategy is based on “Decision Rules and Maximum Initial Withdrawal Rates” by Jonathan Guyton and William Klinger, Journal of Financial Planning, March 2006, with modifications that we believe enhance the work presented in this research study.

Past performance and advice regarding client accounts cannot guarantee future results. As with all market investments, client investments can appreciate or depreciate. Evergreen does not guarantee or warrant that services offered will result in profit.

EVERGREEN’S INSURANCE CANOPY:

Evergreen’s Insurance Canopy—a comprehensive service that dives deep into your home, auto, and umbrella policies to ensure you’re neither overinsured nor underinsured. We provide a simple report that highlights any gaps or areas of concern, using a clear system: green light for good, yellow light for caution, and red light for issues that need immediate attention.

EVERGREEN 10-YEAR TAX PLAN:

At Evergreen, we’ve created the Evergreen 10-Year Tax Plan, a forward-looking strategy designed to help map out key financial moves year by year. This includes Roth conversions, retirement contributions, tax-efficient distributions, tax-loss harvesting, and charitable giving. Our plan is crafted to help you manage, reduce, and defer taxes over time, with the goal of helping you retain more of what you earn.

TAX PLANNING:

It’s not what you make on your investments; it is what you keep that counts.

Ways that we manage the taxes:

- Tax harvesting Educational Resources – Evergreen Private Wealth

- Asset Location Educational Resources – Evergreen Private Wealth

Ways that we defer taxes:

- Retirement plans

- Health plans

- Roth Conversion

Ways that we lower your taxes:

- Small business tax strategies

- Tax efficient distribution strategies

Because Evergreen’s services include the wide-ranging nature of financial planning, Evergreen may provide ideas and insights to the Client related to tax planning or legal advice. Clients must always first consult with their tax or legal professional regarding the efficacy and impact of the ideas that Evergreen proposes before taking any action.