Here at Evergreen, we strive to set up our clients, and their friends and family, for success by educating them on principles that will benefit them throughout their lives. We do this by not simply telling our clients what to do but teaching our clients finance concepts and best practices. We avoid complex terminology and financial jargon in order to help our clients best understand what we are doing and why we are doing it. In the earliest process of onboarding a new client, we ask them to read a few select chapters from “Simple Wealth, Inevitable Wealth”, which we send to help them gain a better understanding of our investment philosophy. These chapters do a great job of outlining one of our most important philosophies: Over the long-term, stocks are less risky than bonds.

Clients will not learn everything all at once, but we aim to help them learn more and more and slowly build up their overall financial knowledge with each review we have with them. Many clients have told us that they have learned more working with us in a few short years then over their entire lifetime. We want our clients, and their loved ones, to feel empowered and educated so they can pass on their financial knowledge for generations to come.

FAQ

Evergreen’s Philosophy on Asset Allocation

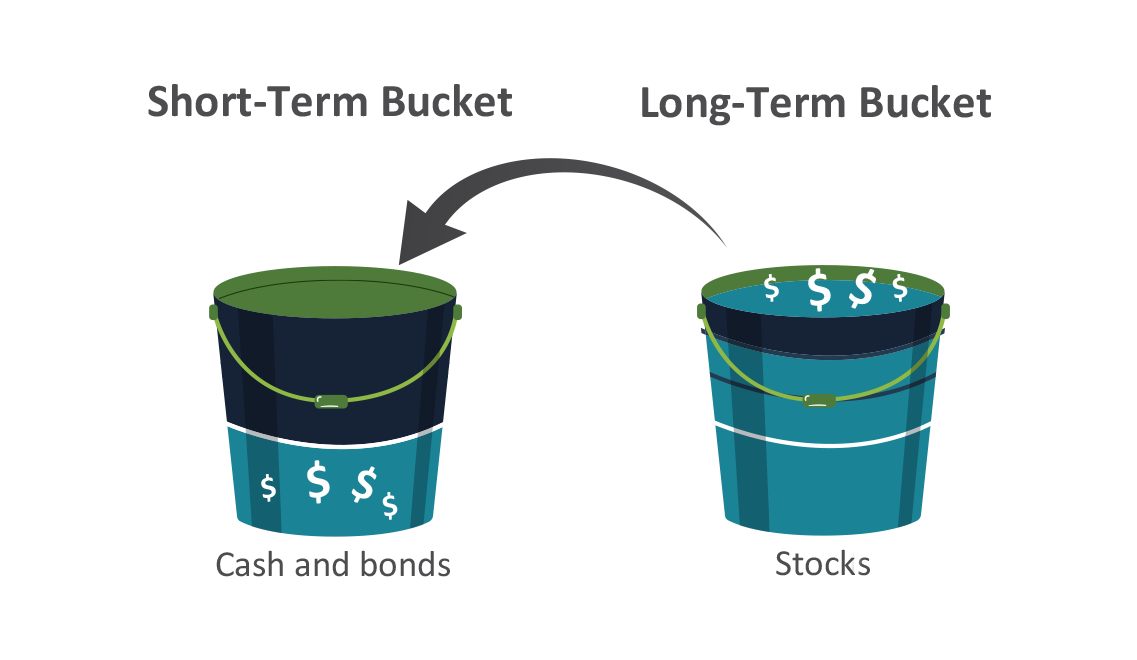

Asset allocation based on:

- Short-term bucket to cover a minimum of 5 years’ worth of portfolio withdrawals

- Individual investor’s risk tolerance

Strategy:

- When the stock market is down we pull from the short-term bucket, allowing the long-term bucket time to recover and grow

- When the stock market is up we sell from the long-term bucket to replenish the short-term bucket

- Over the long run stocks have outpaced inflation

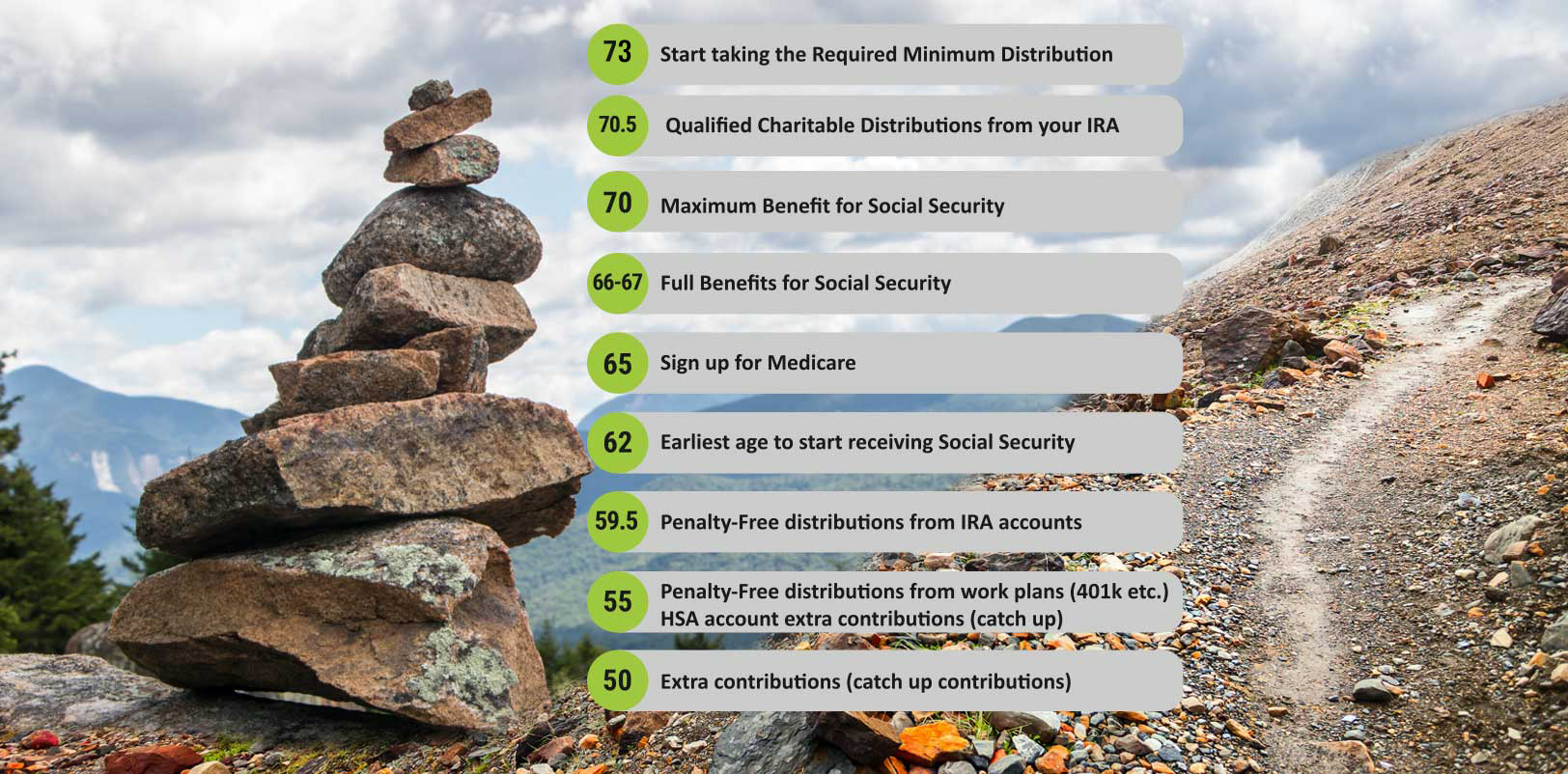

Evergreen’s Retirement Pathway

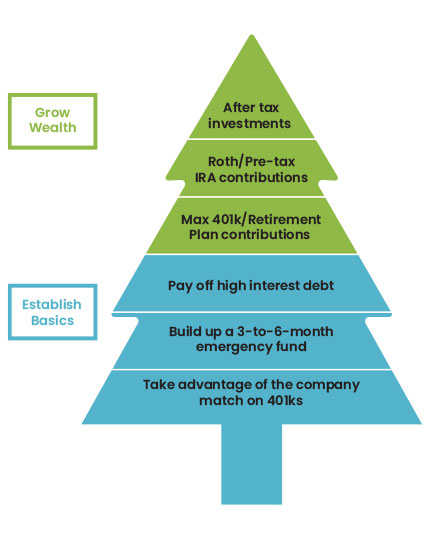

Evergreen’s Savings Hierarchy

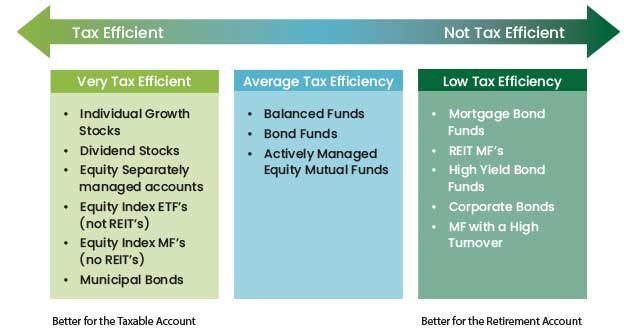

Tax-Efficient Investing:

Many people know about asset allocation but most do not know the importance of asset location

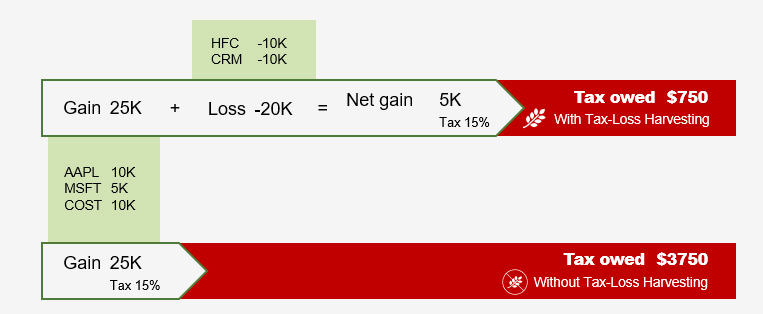

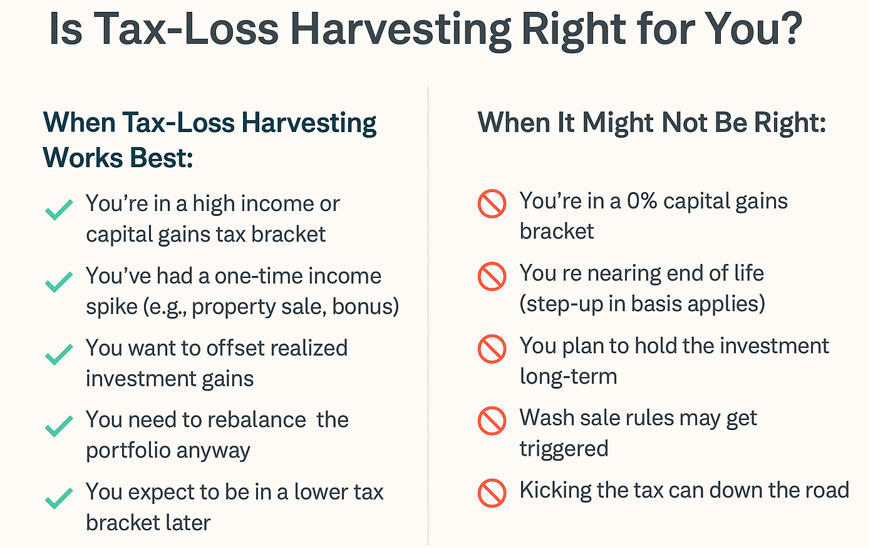

How Tax-Loss Harvesting Works:

Tax-loss harvesting is a strategic method Evergreen use to reduce taxable income and enhance after-tax returns by selling investments at a loss in taxable accounts. It’s applied when it supports a client’s broader financial goals, particularly for those in high tax brackets, facing one-time income events, or managing Medicare and tax thresholds.

We prioritize maintaining portfolio strategy and integrity, only harvesting losses when it provides meaningful long-term value. Key considerations include a client’s income, life expectancy, and future tax outlook. We avoid scenarios where harvesting may be counterproductive, such as during 0% capital gains windows or near end-of-life. The process is supported by advanced tools and a disciplined review of assets, with clear communication around tax implications.